Headline

Where are Americans moving to? Well, other parts of the USA mostly. But which cities have a growing population and which are shrinking? It’s an important question for property investors who are trying to track the demand side of the supply-demand equation. Unfortunately official data is rather tardy and up to date information is hard to come by. We know very well that the Texan cities saw the highest rates of population growth while the oil price was good and high during 2008-2014, but are they still growing now that the oil industry is in recession?

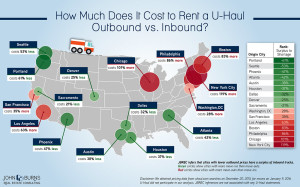

I came across some interesting research this week from Norada, a real estate firm in Tennessee. They have analysed the cost of one-way moving truck rental costs between 16 of the biggest cities in the USA. The logic is that since it costs much more to hire a truck from NY to Atlanta than it does to hire a truck from Atlanta to NY, the company must have a surplus of trucks in Atlanta from people who have moved there, and a deficit of trucks in NY because people are moving out.

According to this analysis there are some results that are expected – expensive cities NY, SF, LA and Boston are seeing people move out and cheaper places like Atlanta and Pheonix are seeing people move in. There is notable growth in the ‘cheaper tech’ cities of Seatle and Portland. Some results though I did not expect – the Texan cities are still growing even with the oil price so low, and Chicago, which has very cheap property prices for a megacity, is seeing people move out.

Interesting stuff, and it’s good to see new ideas out there for analysing the world of property. I can only hope that next time there is good research like this that it will cover more cities.

Receive updates by email

On Bubbles and Bitcoin

/0 Comments/in blog, Finance and economics, Financial Markets, Investing /by Andy+China’s Balancing Act

/0 Comments/in blog, Economics, Uncategorized /by Andy+FAANGs for the Memories

/0 Comments/in blog, Financial Markets /by Andy+