Is the HKMA in danger of losing control of the peg?

There was an interesting article by Jake van der Kamp in the South China Morning Post last week on the subject of the HKMA and the USDHKD peg. It’s well worth reading for a very clear and concise explanation of how a currency board system works – a system talked about more often than it is properly understood, even by FX professionals.

It is widely accepted that a currency board is a much more reliable way of pegging a currency than the alternative, a system based solely on central bank reserve intervention. It does have it’s disadvantages of course, but the reliability of the peg is certainly not one of them. The currency board system kept the USDHKD peg in place during some very serious tests of the past: the 2008 stock market crash, the SARS scare, and the Asian crisis which saw only the HKD and CNY escape serious collapse out of all the east Asian currencies. For all it’s faults, the system has done what it was supposed to do.

Van der Kamp appears to be worried that the HKMA is about to change from a currency board system to a reserve-based system, and here is where I do not share his concerns. It is true that when US interest rates were at almost zero, the currency board system ceased to function and the HKMA had to intervene to buy USD whenever the FX tried to push below 7.75. However, if spot were to go to 7.85, it is far from certain that the HKMA would use intervention (as opposed to the currency board rules) to keep the peg in place. Even if the HKMA did use some reserves it would not automatically signal a change in regime. The HK monetary base is USD 205 bn and the HKMA reserves are USD 359 bn. If we assume that reserves need to be 110% of the monetary base to have a viable currency board system in operation, the HKMA can still sell USD 133 bn of reserves in the open market without putting the current system in jeopardy. Certainly, there has been no official sign that the HKMA or the Finance Secretary is considering a change from the current FX pegging system to a less reliable one.

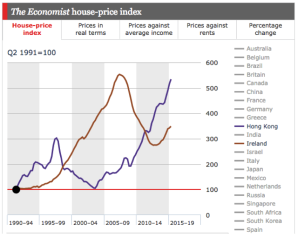

The problem with the currency board is not at all that it will be abandoned when it matters (as Argentina did with it’s under-funded and leaky system in 2002). A far bigger issue is that the system frequently leaves Hong Kong with wholely inappropriate interest rates: rates that are required to keep the FX target, rather than target inflation. For much of the past six years, Hong Kong interest rates have been dragged down to a level that was appropriate for the USA, not for Hong Kong. As Ireland found out when it joined the euro, if you have interest rates too low, mortgages are too cheap and property becomes too expensive. The Irish property boom increased residential prices by 407% over 12.5 years of mostly low interest rates before collapsing 50% in the crash. Interestingly Hong Kong property prices have gone up 404% during the 12 years since the SARS low in 2003, again with interest rates inappropriately low for much of the time.

Hong Kong has average property prices at 37 times average annual salary, the most expensive in the world by this measure. A bubbly property market caused in part by low interest rates is only the beginning of the concern. If USDHKD were to push the top of the band – and with the USD strong across the board this would not be an unusual state of affairs – the currency board system would automatically push Hong Kong interest rates higher to the rate needed to keep the FX peg in place. The more pressure on the currency, the higher rates would automatically go.

Worrying about the USDHKD peg failing under speculative attack is like worrying about the position of the deck chairs on the titanic. The real iceberg on the horizon is what happens to the Hong Kong property market and economy under speculative attack. That’s the consequence of the currency board that journalists should really be focusing on.

Receive updates by email

Headline

Text body

Receive updates by email

On Bubbles and Bitcoin

/0 Comments/in blog, Finance and economics, Financial Markets, Investing /by Andy+China’s Balancing Act

/0 Comments/in blog, Economics, Uncategorized /by Andy+FAANGs for the Memories

/0 Comments/in blog, Financial Markets /by Andy+